All Categories

Featured

Table of Contents

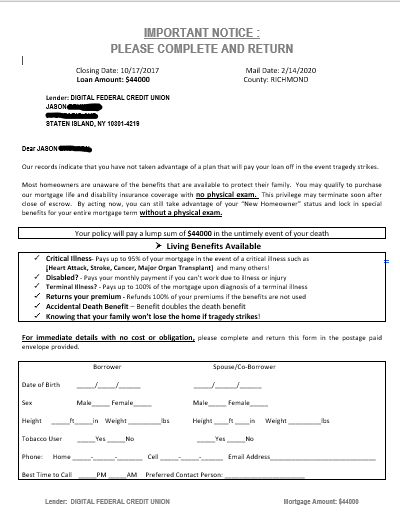

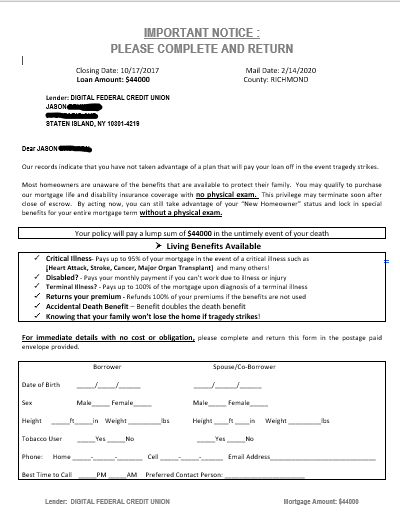

Term life insurance coverage may be much better than home loan life insurance policy as it can cover home mortgages and other expenditures. Compare life insurance policy online in mins with Everyday Life Insurance. Mortgage life insurance, also called, home loan defense insurance, is marketed to house owners as a means to pay off their home loan in situation of death.

It seems excellent, it might be much better to obtain a term life plan with a large death advantage that can cover your home loan for your beneficiary. Mortgage life insurance policy pays the remainder of your mortgage if you pass away throughout your term. "Mortgage defense insurance coverage is a means to discuss insurance policy without pointing out passing away," says Mark Williams, Chief Executive Officer of Brokers International.

Unlike a conventional term life insurance policy that has the same costs, it's prices and the death advantage normally reduce as your home loan lowers. This insurance is typically perplexed with exclusive mortgage insurance, however they are extremely different ideas. home insurance for mortgage loan. If you have a mortgage and your down repayment is less than the average 20%, your lending institution will need home loan insurance policy to protect them in instance you back-pedal your home mortgage repayments

Williams stated an individual can call a partner as the recipient on a home mortgage protection insurance coverage. The partner will obtain the cash and can select whether to repay the mortgage or sell your house. If a person has mortgage life insurance and a term life plan with the partner as the recipient on both, after that it can be a dual windfall.

Decreasing term insurance policy is the extra common kind of mortgage life insurance policy. With this plan, your insurance coverage costs and coverages lower as your mortgage quantity lowers.

Life Insurance For A Mortgage

Mortgage life insurance policy additionally calls for no clinical exams or waiting periods. If you pass away with a superior mortgage, home loan life insurance policy pays the remainder of the lending straight to the lending institution. Subsequently, your enjoyed ones don't need to manage the financial concern of settling the home loan alone and can concentrate on grieving your loss.

Your home loan life insurance policy plan is based upon your mortgage amount, so the details will certainly differ depending upon the expense of your home mortgage. Its prices lower as your home loan decreases, however costs are normally a lot more costly than a standard term life policy - loan protection life and disability insurance. When choosing your death advantage amount for term life insurance policy, the general rule is to pick 10 times your yearly revenue to cover the home loan, education and learning for dependents, and other costs if you pass away

Your home mortgage life insurance policy ends when your home loan is paid off. If you pay off your home mortgage before you die, you'll be left without a death benefitunless you have various other life insurance.

Mortgage Insurance Job Loss

Both most common long-term life insurance coverage plans are entire life and global life insurance policy. With a whole life policy, you pay a fixed costs for an assured survivor benefit. The policy's cash worth also expands at a fixed rate of interest. On the other hand, a global life policy allows you to adjust when and just how much you pay in costs, consequently readjusting your coverage.

Mortgage life insurance coverage might be an excellent choice for property owners with wellness problems, as this insurance coverage provides prompt coverage without the need for a medical examination. However, standard life insurance policy may be the very best option for the majority of individuals as it can cover your mortgage and your other economic obligations. Plus, it tends to be more affordable.

Nonetheless, you can likewise call other beneficiaries, such as your spouse or kids, and they'll get the fatality advantage. With lowering term insurance, your coverage decreases as your home loan decreases. With level term insurance coverage, your coverage amount remains the exact same throughout the term. No, lending institutions do not need home loan life insurance policy.

Life Insurance For Mortgage Uk

Yes. One perk of mortgage life insurance coverage over a standard term policy is that it commonly doesn't require a medical examination. Homeowners with pre-existing conditions normally certify for this insurance coverage, however it's important to check with the policy company to confirm any type of exemptions or limitations. Ronda Lee is an insurance coverage professional covering life, automobile, homeowners, and renters insurance policy for consumers.

ExperienceAlani is a previous insurance policy fellow on the Personal Finance Insider team. She's reviewed life insurance coverage and family pet insurance provider and has composed countless explainers on traveling insurance policy, credit scores, debt, and home insurance coverage. She is enthusiastic regarding debunking the complexities of insurance policy and other individual finance subjects to make sure that viewers have the info they require to make the very best cash decisions.

When you obtain a mortgage to acquire your home, you will typically need to secure home loan protection insurance coverage. This is a particular sort of life guarantee that is obtained for the term of the home mortgage. It repays the home loan if you, or someone you have the home mortgage with, dies.The lending institution is lawfully called for to ensure that you have home mortgage protection insurance policy before providing you a home mortgage.

What Insurance Is Needed For A Mortgage

If you pass away without mortgage insurance defense, there will be no insurance coverage to repay the mortgage. This indicates that the joint proprietor or your beneficiaries will have to continue paying back the mortgage. The need to take out mortgage protection and the exemptions to this are set-out in Area 126 of the Consumer Credit Score Act 1995.

You can obtain: Minimizing term cover: The quantity that this policy covers decreases as you pay off your home loan and the plan ends when the mortgage is paid off. Your premium does not alter, also though the degree of cover lowers. This is the most usual and most inexpensive type of home mortgage security.

So, if you die before your home loan is paid off, the insurer will certainly pay out the initial amount you were insured for. This will certainly pay off the home loan and any continuing to be balance will certainly most likely to your estate.: You can include severe disease cover to your home loan insurance plan. This implies your home loan will be settled if you are identified with and recuperate from a major illness that is covered by your plan.

This is a lot more pricey than other kinds of cover. Life insurance policy cover: You can utilize an existing life insurance policy plan as home loan protection insurance. You can only do this if the life insurance policy plan offers enough cover and is not assigned to cover one more financing or home mortgage. Home mortgage payment protection insurance is a kind of repayment security insurance.

Mortgage Life Insurance Sales

This kind of insurance is typically optional and will usually cover payments for 12 months - should you get mortgage protection insurance. You should examine with your home mortgage lending institution, insurance broker or insurer if you are unsure concerning whether you have mortgage payment defense insurance coverage. You ought to likewise check exactly what it covers and guarantee that it suits your situation

Mortgage life insurance policy is much less versatile than term or entire life coverage. With a home loan life insurance policy policy, your beneficiary is your mortgage lending institution. This means that the cash from the advantage payout goes directly to your home mortgage lender. Your family never ever deals with the dollars that are paid out and has no say in just how that money is utilized or dispersed.

Disability And Unemployment Mortgage Insurance

Securing a home mortgage is just one of the greatest duties that grownups face. Falling back on mortgage settlements can result in paying more interest charges, late charges, foreclosure procedures and even shedding your home. Home loan security insurance coverage (MPI) is one means to secure your family members and financial investment in situation the unthinkable takes place.

It is particularly helpful to individuals with expensive home loans that their dependents could not cover if they passed away. The vital distinction in between mortgage protection insurance coverage (MPI) and life insurance policy depends on their coverage and flexibility. MPI is especially created to pay off your home mortgage equilibrium directly to the loan provider if you die, while life insurance policy offers a broader death benefit that your recipients can utilize for any kind of financial needs, such as mortgage settlements, living expenses, and financial obligation.

Latest Posts

Final Expense Market

Funeral Home Insurance Policy

Funeral Burial Insurance Policy